The Child Tax Credit (CTC), a federal income tax credit in the United States, was created to help families offset the costs of raising children.

The CTC allows taxpayers to reduce their federal income tax liability dollar-for-dollar by the amount of the credit.

According to the White House, the amount of the credit varies depending on the taxpayer's income and the number of qualifying children.

It is available to families with qualifying children, as defined by the tax code, who live with them for more than half of the year.

The purpose of the CTC is to provide financial assistance to families with children, reducing the amount of taxes they owe and potentially increasing their tax refund.

With that, here are the changes to the requirements and eligibility for claiming the child tax credit in 2023.

The Child Tax Credit this 2023

Since the Child Tax Credit for 2021 expired in December, the Internal Revenue Service (IRS) has reverted to the version it used to offer to low-income families before the pandemic.

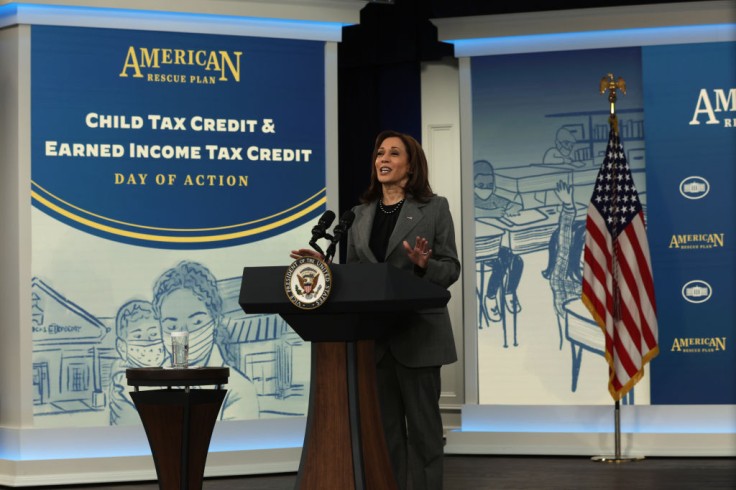

As reported by Fortune, in 2021, the American Rescue Plan temporarily expanded the CTC as part of the COVID-19 relief effort, providing families with up to $3,000 per child and up to $3,600 for children under six years old. The expanded CTC was available for the 2021 tax year only.

For the 2023 tax year, the CTC has been made permanent at a maximum credit of $2,000 per child.

Furthermore, despite the apparent gap between the amount every family could receive from the CTC in 2021 and now in 2023, President Joe Biden has expressed his desire to expand it further as part of the American Rescue Plan.

President Biden is calling on Congress to restore the full Child Tax Credit – which gave tens of millions of parents more breathing room and cut child poverty in half.

— The White House (@WhiteHouse) February 8, 2023

Child Tax Credit requirements and eligibility

In terms of eligibility, a child must be under 17 and be a U.S. citizen or resident alien to receive the CTC. The child must also live with the taxpayer for more than half the year, and the taxpayer must provide over half of the child's support.

According to AS, the child must meet the requirements to be claimed as a dependent on the taxpayer's tax return and spend more than half the year living at the same address as the taxpayer for tax years 2022 through 2025.

During the tax year, the child is not permitted to provide more than 50 percent of their financial support.

The child must have a valid taxpayer identification number, which comes in the form of a Social Security number (SSN) authorized for work.

Because of this, documented immigrants and permanent residents were also eligible to claim the credit for themselves.

To be eligible for the full credit, the parents of a child who is qualified for the program must have an adjusted gross income (AGI) of less than $200,000 for single filers or $400,000 for married filers filing jointly.

The credit is reduced by $50 for every additional $1,000 (or a fraction thereof) spent over those thresholds.

To qualify for the refundable portion of the credit, low-income Americans in the United States must have an annual income of at least $2,500. A portion of the earnings over that amount is what can be claimed.

Related Article: Helicopter Parenting: Why It May Not Lead to Success